5 Ways to Answer “Should You Invest While In Debt?”

We all know that the earlier we can start investing the better because compound interest works best over a long period of time. But when should you start investing? What if you still have a lot of debt? Should you invest while in debt?

Are You Ready to Invest Checklist

Before you get started investing, here are a few items that are crucial to get checked off first.

- 3-Month Emergency Fund Minimum

- High-Interest Debt Paid Off

- Not Living Paycheck to Paycheck

- Educate Yourself

Many investing experts agree that these 4 things need to happen before you get serious about investing. Check out books like Broke Millennial Takes On Investing and Dumb Things Smart People Do With Their Money with a more detailed breakdown of this checklist.

You’ll notice that this list does not say “pay off all debt” but rather, “pay off high interest debt.” So that leads us to the 5 ways to answer the question, “should you invest while in debt?”

5 Ways to Answer “Should You Invest While In Debt?”

To answer the question, “Should you invest while in debt?” we will explore it from two different angles… the numbers, and the emotions.

Let’s dive in to find out if should you invest while in debt.

Numbers Answer #1

Pay off high interest debt first.

It’s pretty simple. If you have a credit card with 25% rate, then “investing” in paying off debt almost always makes the most sense.

Because by paying that off you are essentially getting a guaranteed 25% return on your money.

You will never come anywhere close to a ‘guaranteed’ investment that will yield that. The average rate of return in the market is between 7% to 11%. Therefore, your money will not be put to its best use in the market.

I consider anything over 6% to be “high-interest” debt because 7% is what you can typically get as a minimum average when your money is in the market.

Numbers Answer #2

Invest when you have low interest.

If you have a mortgage or student loans with a 3% interest rate and the average stock market returns are 10%, then mathematically it makes sense to NOT pay off your house early and instead invest extra money into the stock market index fund.

Once you have paid off those higher interest debts, and only have lower interest debts left, you will be doing yourself a favor by focusing on getting better returns from the market.

Numbers Answer #3

Start investing early to take advantage of compound interest.

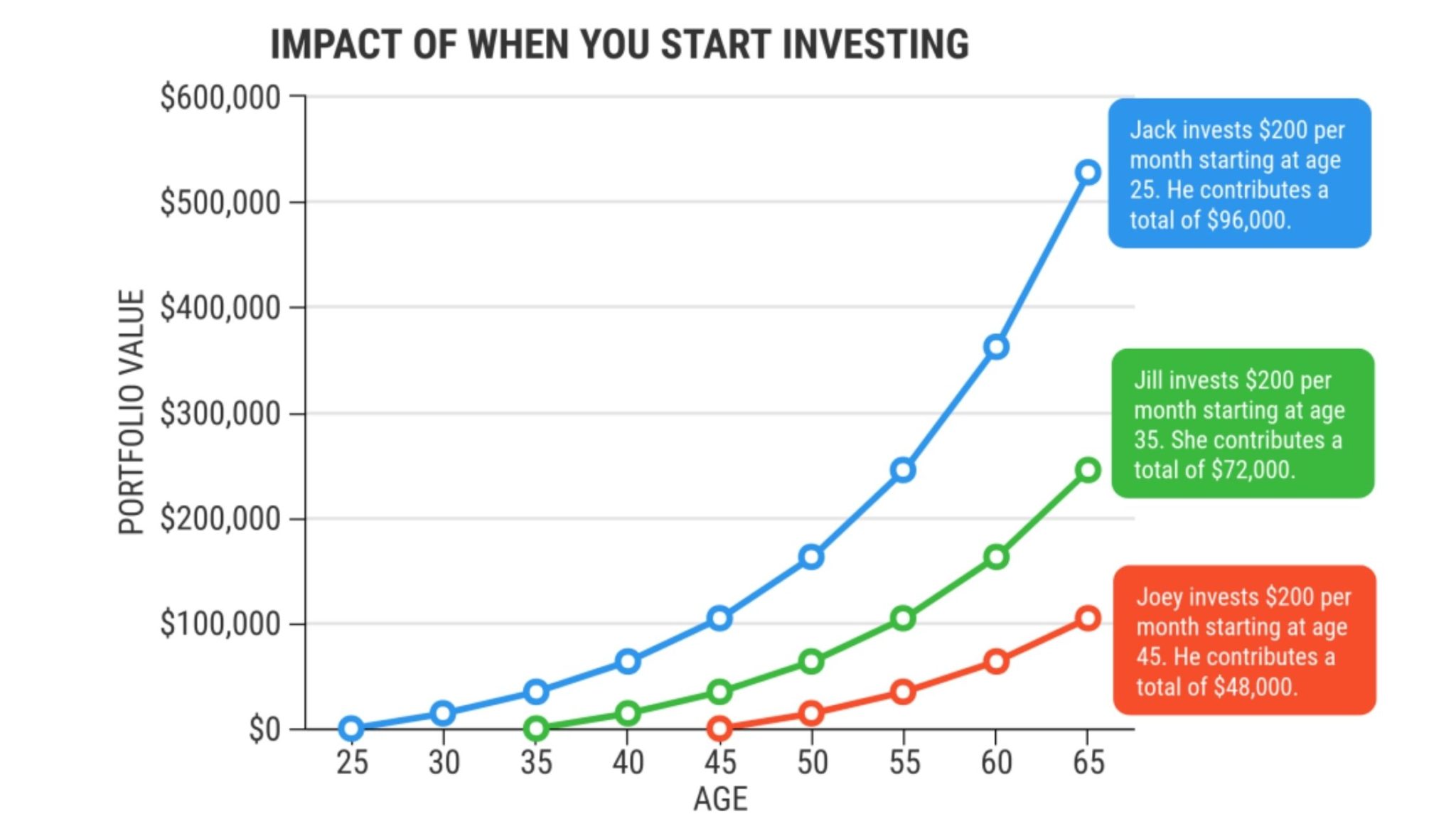

Looking at this from another perspective, the most powerful factor that has resulted in most investors’ success is TIME. Why? Because compound interest works best with time.

The person who starts earlier has a huge advantage over the one who starts later down the road.

Look at this simple comparison of Jane and Chris for example:

- Jack invested $200/mo – a total of $96k – and ended up with $520k.

- Jill invested $200/mo – a total of $72k – and ended up with $245k.

- Joey invested $200/mo – a total of $48k – and ended up with $100k

Check out this second example:

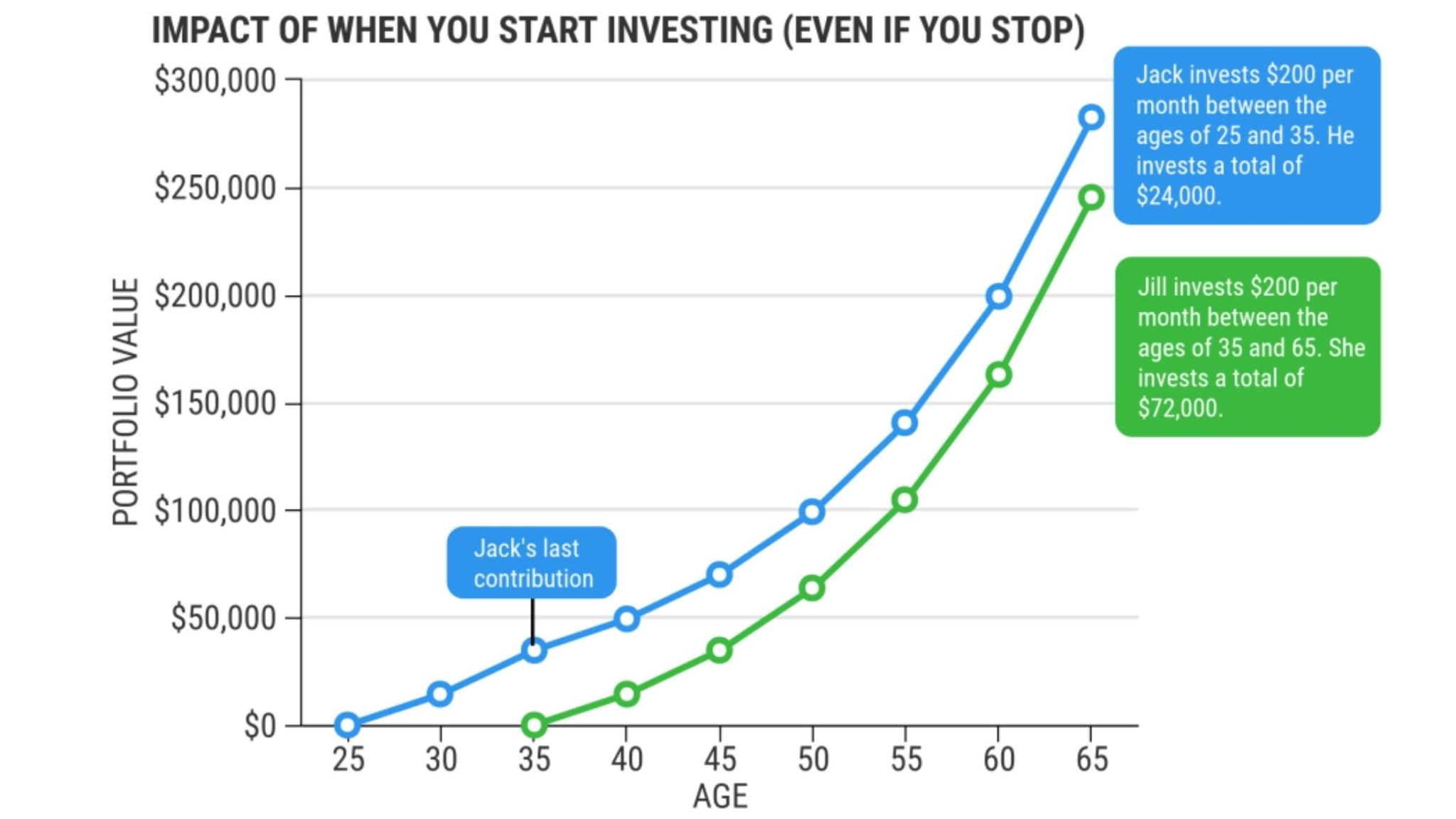

- Jack invests $200/mo for only 10 years starting at 25 years old – a total of $24k – and ended up with $300k

- Jill starts at age 35 and invests $200/mo for 30 years – a total of $72k (3 times more than what Jack invested) – and still only ends up with $245k!

The difference was simply that Jack started earlier. If you feel like you are late to the party, don’t get discouraged, it is always better late than never. But if you are still young-ish – don’t miss the power of of compound interest.

Jill invested 3x what Jane did, but Jack used TIME to maximize his growth.

Emotional Answer #1

Being emotionally free from debt.

My husband and I paid off our student loans early even though the interest rates on each loan was 3% to 5%. Why? Because we loved the idea of paying off our student loans early.

Debt is a form of slavery, according to the Bible, and we simply wanted to be free from that bondage. It is a huge emotional burden that has been lifted off our shoulders.

It’s not for everyone, but it was for us, and I’m so glad we chose to do it that way.

Emotional Answer #2

Becoming educated earlier on.

The reason I started investing while I still had debt – and why I would do it again – was because I viewed it as education.

We started investing in real estate only 3 months after getting married. We were only 24 and we bought our first duplex. We have made a lot of mistakes in the early years of our investing journey, but I am thankful for the lessons I learned early on when we didn’t have a lot of responsibilities on our shoulders just yet.

I knew that the sooner I started investing, the sooner I would really start learning how to become a good investor.

Looking back, what I learned from those first few investments we made all those years ago has been critical to the investing successes I have had now.

I have learned risk tolerance and not letting my emotions cloud my judgment.

Learn what the Bible says about investing.

Summing it Up

I am all for getting debt paid off ASAP. Especially if you are paying really high interest rates, because you will have a hard time beating that “guaranteed return” of paying off your debt.

But, the advantage granted to investors who start early is a big one that should be taken into consideration.

If you can’t decide what is best for you, maybe consider doing a bit of both. This doesn’t have to be an either/or proposition. Consider how much money you are saving every month and divide it into two parts and put one portion towards overpayments on your debt, and the other towards your investments.

So what do you think? Do you believe you should invest while in debt?

Need Help With This?

Getting into investing for the first time as a young professional can feel a bit overwhelming. The first thing you need to do on your journey to debt freedom is to pick a debt payoff strategy and to create a budget that will help you stay on track.

But budgeting can be challenging and sticking with your debt payoff journey will get tough! I would love to help answer all of your questions to my best ability, and help keep you accountable to your plan through my free online community.

The Redeeming Your Finances community is designed to equip young professionals with excellent money management skills that are rooted in the Gospel. Come join in the conversation about investing and money management today!

You May Also Like

3 Big Money Mistakes That Are Keeping You From Building Wealth

How to Create Awesome Criteria for Buying Rental Properties

Tips for Budgeting With an Irregular Income

25 Simple Ways to Start Saving Money Today