How to Plan a Debt-Free Christmas By Creating a Christmas Budget

Oh, Christmas! The most expensive time of the year!

That’s the saying, right? Wrong! But that’s what it feels like though…

Having a plan for your Christmas spending is crucial for not going overboard or even into debt over this wonderful holiday. In this article, we will look at some Christmas spending statistics, the benefits of having a Christmas budget, and how to plan out your Christmas budget this year!

Christmas Spending Statistics

In a 2019 study on Christmas spending, 93.4% of Americans bought Christmas gifts last year, and the average person spent $882.45 on gifts, food, decorations, travel, and other holiday-related expenses (and that includes the people who DIDN’T buy gifts!) 21.5% of the people they studied, went into debt over Christmas expenses, and only 29% of those people that went into debt have a plan for how to pay it off. The rest of those people have no idea how they will get out of debt, let alone before Christmas this year!

We want to make Christmas special and magical, just like it felt when we were kids! Maybe it’s to impress our significant others or to make things wondrous for our children. But to do these things, we don’t have to go overboard and we certainly don’t need to max out our credit cards.

In our household, our Christmas celebration is practically the whole month of December, and the purchases start as early as September some years! You’ll want to create your Christmas budget as early as possible, that way you can be prepared and not go into any sort of debt over your own celebrations and plans.

So let’s talk about how to plan a debt-free Christmas this year while at the same time, making it as magical as possible!

How to Create a Christmas Budget

Build your Christmas budget just as you would build your everyday budget, and start with your motivations and goals.

Motivations & Goals

What are you looking to accomplish this Christmas season? Are you trying to wow everyone with your lavish dinner parties, fancy outfits, and expensive presents? Are you looking to have a bit humbler Christmas and go shoot for small yet thoughtful? Or maybe you are somewhere in-between the two.

Whatever you are hoping to make Christmas this year, keep that in mind as you build your Christmas Budget.

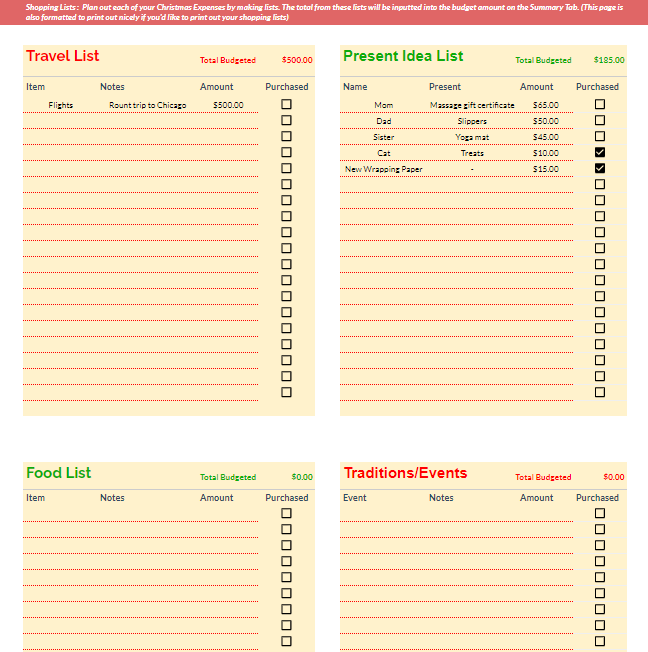

Need a place to keep you budget? Check out my Christmas Budget Spreadsheets.

How Much Will You Spend

Decide now how much you want to spend on Christmas as a whole. How much do you have to work with when it comes to buying presents, paying for plane tickets, and experiencing winter’s best.

Plan Out Your Expenses

Now that you know how much you have to budget for each of your Christmas expenses, let’s look into the expenses that come along with Christmas.

What to Plan For In Your Christmas Budget

What expenses should you include in your Christmas budget? Think about your own Christmas traditions and what all you typically pay for.

Here are the things you should plan for when it comes to your Christmas budget.

7 Expenses to Plan For in Your Christmas Budget

1. Presents

The first thing on the list that most of us could never forget about is all of the presents. I recommend that you make a list of all of the people that you plan to buy presents for this year.

List out each family member, friend, teacher, mentor, etc, and decide now how much you want to spend on their present. This process has been extremely helpful for my husband and me to have a debt-free Christmas. We love getting presents, but when we don’t limit our spending, we tend to go overboard. So by doing this, we know exactly how much we can spend on each person.

TIP: Don’t forget to factor in wrapping paper, gift bags, tape, and bows! These little things add up. Try buying these things in January to get them when they’re on sale. Or head to your local Dollar Store for discounted present wrapping options!

Check out this list of over 20 different experience-based gifts to give this year!

2. Travel

Many of us travel to visit friends and family over Christmas or plan to take a family vacation while the kids are on winter break. Don’t forget to plan for your travel expenses, whether that is plane tickets, gasoline for your car trip, hotel rooms, or rental cars.

Holiday travel can be very expensive, so I recommend planning ahead and try to find your accommodations early in the year, that way you don’t get stuck paying last-minute high prices!

Find out how you can get free parking at the airport.

3. Food

Christmas tends to include lots and lots of food when it comes to our family. Is that the same for yours? Create a budget for how much you plan to spend on food over Christmas.

Are you hosting a big dinner? Did you sign up to bring pies to your aunt’s party? Maybe you cook a big feast for your family on Christmas day?

This budget should also include all of your desserts, treats, and goodies! Do you put out cookies and milk for Santa? Are you on the list for a cookie exchange party? Don’t forget these expenses!

Make sure you’re earning cash back on all of your grocery purchases using these cash back methods!

4. Decorations

Hopefully, you have a collection of decorations for Christmas already, but if you don’t make sure to plan out how much everything will cost. Some typical Christmas decorations are Christmas trees, wreaths, outdoor lights, cookie scented candles, ornaments, etc.

Even you have your regular decoration collection built up, there are still some decorations that many people plan to buy every year. Do you enjoy the smell of a real Christmas tree? Or like having real wreaths on the outside of your house?

Did your Christmas lights get cut by your teenage boy neighbors and now you need to replace them? (true story…) We like to buy a new ornament every year to add to our collection.

TIP: Don’t have your staple Chrismas decorations like a tree or outdoor lights? Wait until January to buy these things, and you should be able to find great deals on them!

Also, the Dollar Tree has awesome small decorations if you want to go the frugal route!

5. Traditions/Events

I grew up out in Chicago and when I was a kid, we used to go to Navy Pier’s Winter Wonder Fest every year to enjoy the Christmas themed bouncy houses and to go ice skating. Living in Colorado now, my husband and I try to make it out to the Denver Zoo Lights for a magical stroll.

What are the traditions you enjoy with your family? If you mainly enjoy free traditions, high-five! If you have traditions that you need to pay for don’t forget those!

Here are some things you may have on your list to enjoy this year; attending The Nutcracker Ballet, building a gingerbread house, family movie night at the theatre, skiing, and tubing.

6. Family Christmas Cards

If you plan to send out family Christmas cards, don’t forget to factor those into your Christmas budget. We try to buy ours during the fall time because most places offer an “early bird” discount when you buy before November!

Don’t forget to account for any stamps or return address labels you will need as well.

7. Donations

Many churches, nonprofits, and other organizations offer extra opportunities to give each year. Our church offers the opportunity to donate to Prison Fellowship through their Angel Tree program. We typically sponsor two children that way each year.

I encourage you to look for more ways to give this year. How can you spread the love of Christ to those around you this season?

Remember, what Christmas is truly about. Your season will not be defined by how much you spend or don’t spend.

Related: Bible Verses About Gratitudte to Inspire Your Generosity

Does a Christmas Budget Really Work?

Whether or not a budget ever works is totally up to you. If you put in the time, effort, and dedication to sticking to the budget, then YES, a Christmas budget will really work.

The worst thing that could happen to you by trying out a Christmas budget this year, is that you help save yourself a little bit of money!

Check out my easy to use Christmas Budget Spreadsheets for Google Sheets here.

Related Budgeting Articles

What’s the Difference Between Money Tracking and Budgeting?

What Does the Bible Say About Budgeting?

Don’t Fall For These 3 Budgeting Myths

Top 3 Biggest Budgeting Challenges and How to Overcome Them

You May Also Like

What Does the Bible Say About Debt?

Over 20 Different Experience-Based Gifts To Give This Year

My Favorite Bible Verses on Giving

How to Pick a Debt Payoff Strategy

Something most of us need to think about. Thanks for putting this out there

Hey Mandy, thanks for checking out the article. October tends the be when people start making purchases for Christmas. Not to mention all of the decorations that have already been in the stores!! It’s never too early to start a Christmas budget!