How to Create a Budget in 5 Steps

Budgeting is very important especially if you are on the journey towards financial independence. Some people find that budgeting is just restricting what you can spend money on. But don’t fall for that budgeting myth!

Budgeting is more like telling your money where to go in order for you to be able to do more in the long run.

In fact, Dave Ramsey puts it this way, “A budget is telling your money where to go instead of wondering where it went.”

We want to be able to control our money rather than have our money control us and ultimately free our money for what matters most to us. Everyone’s money goals will be different and what we all value will be different, but we must set ourselves up for success, and that includes creating a budget.

Creating a budget is also a great way to honor God with how we use our money. When we are mindful of how we spend our money, we are saying “no” to it becoming our idol.

Now is a good time to be defensive with your personal finances – start a budget, reduce your spending, create an emergency fund.

Let’s get started… First we must decide WHERE we will keep track of our budget.

Ways to Track A Budget

Where should you keep track of your budget?

The step to take before starting a budget is to decide which tool to use to create your budget. There are a few different options.

Pen & Paper

If you are the kind of person that works best by writing things down then keeping track of your budget with a pen and paper might be your best option.

This does require remembering on your own to add in expenses and things you spent money. The best way to do this is to set up a system like inputting new expenses at the end of every week. That way you stay on top of entering things and you don’t have to play catch up.

Excel

Similar to pen & paper in that you need to do this by hand and remember to input your expenses often. However, using Excel will help keep everything clean and aligned. It will also do all the math for you!

This is a great option for those who want to still do the inputting themselves, but want to make sure it all stays very organized.

Google Sheets

I personally use Google Sheets to track my budget. I love that I can access my spreadsheets from my phone or any computer just by logging into my Google Drive account. This is helpful while I’m out at the grocery store to be able to see how much is left in the grocery budget!

Grab the exact budget spreadsheets I use!

Apps & Programs

There are plenty of budgeting apps and programs out there that will do most of the work for you. All you will need to do is connect your budgeting tool to your bank accounts.

That way, whenever you spend money on something, the budgeting app will automatically know. It typically guesses what category the expense belongs to so you will still need to do some adjusting, but for the most part, it is all automatic.

After picking the best place to track your budget, now it’s time to set it up. Here are the 5 steps to creating a budget.

Step By Step How to Create a Budget

Here are the 5 steps that will teach you how to create a budget.

- Track your spending

- Look at your income

- Observe your current spending

- Adjust your spending (creating the budget)

- Set financial goals

1 ) Track your spending

Before you set parameters on your spending, it is important to track where you are generally spending your money. This requires going back about 3 months and taking note of how much you spend on average on different things.

What are the fixed expenses that do not change? What expenses do change month by month? Write out all of your bills and the expenses you incur once a month.

In this step, you can also begin to create categories that you will use within your budget.

Need some great spreadsheets to help you get started with tracking your money?

Grab the ones I use with my coaching clients here!

Related: What’s the Difference Between Money Tracking And Budgeting

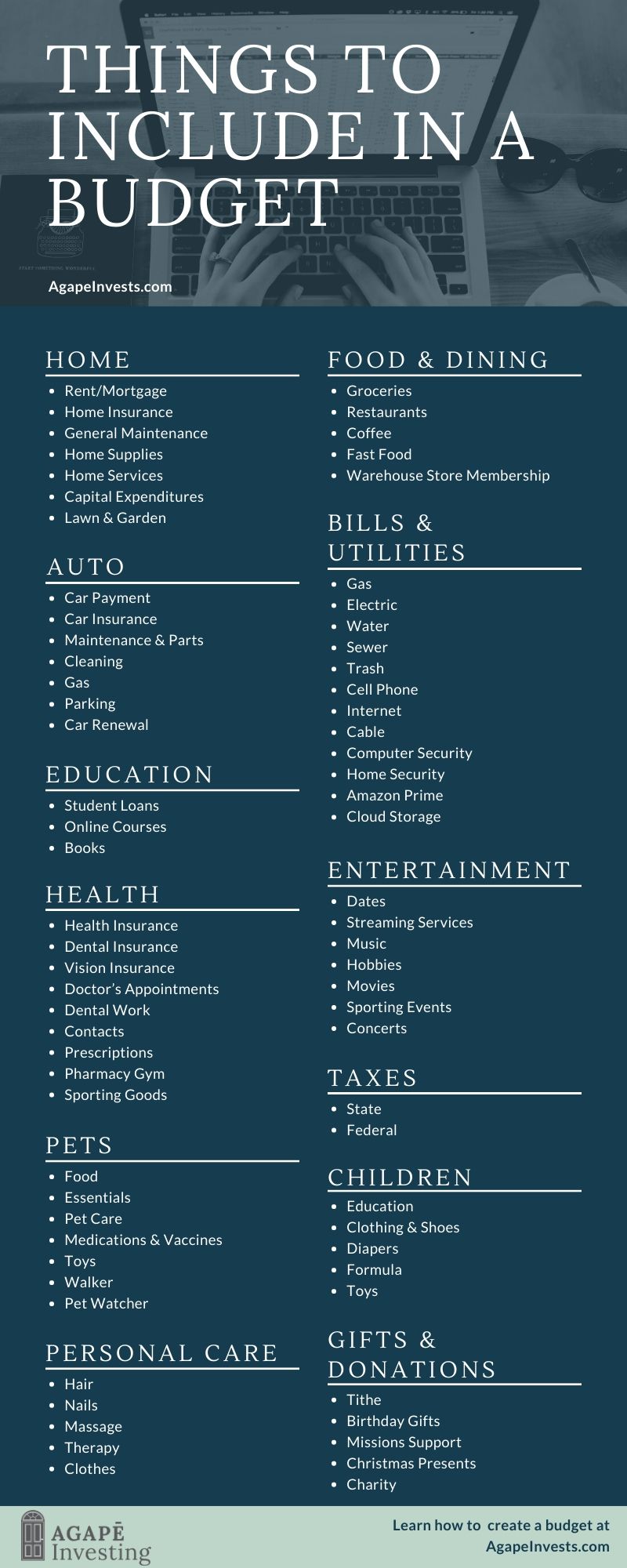

Budget Categories

Home:

Rent/Mortgage

Home Insurance

General Maintenance

Home Supplies

Home Services (pest control, plumbing, carpet cleaning, furnace service, etc)

Capital Expenditures (roof replacement, hot water heater, new furnace, etc)

Lawn & Garden

Auto:

Car Payment

Car Insurance

Maintenance & Parts

Cleaning

Gas

Parking

Car Registration & Renewal

Food & Dining:

Groceries

Restaurants

Coffee

Fast Food

Warehouse Store Membership (Sam’s Club, Costco)

Entertainment:

Dates

Streaming Services (Netflix, Hulu, Disney+, etc)

Music (iTunes, Spotify, Pandora, etc)

Hobbies

Movies

Sporting Events

Outdoor Activities

Concerts

Spontaneity Fund

Taxes:

Federal

State

Real Estate

Pets:

Food|

Essentials (beds, leash, collar, litter tray, pooper scooper, etc)

Pet Care

Medications & Vaccines

Walker

Pet Watcher

Bills & Utilities:

Gas

Electric

Water

Sewer

Trash

Cell Phone

Internet

Computer Security

Home Security

Amazon Prime

Cloud Storage (iCloud, Google Docs, etc)

Health:

Health Insurance

Dental Insurance

Vision Insurance

Doctor’s Appointments

Dental Work

Contacts & Glasses

Prescriptions

Pharmacy

Gym

Sporting Goods (gym shoes, equipment, clothes, etc)

Education:

Student Loans

Online Courses

Books

Gifts & Donations:

Tithe

Birthday Gifts

Missions Support

Christmas Presents

Charity

Weddings/Baby Showers

Children:

Education

Clothing & Shoes

Diapers

Toys

Education

Personal Care:

Hair

Nails

Massage

Therapy

Clothes

2 ) Income

Now write down your income. Is it fixed or does it change every month? If you have an inconsistent income figure out the average.

You can do this by taking the past several months (4 should be fine, but the more you can go back the better) adding them up, and then dividing by how many months you added together.

Month 1: $3,200

Month 2: $2,150

Month 3: $3,550

Month 4: $3,800

Total: $12,700 / 4 = $3175 average monthly income

If your income fluctuates with the seasons, I would recommend taking the average from at least 6 months. That way you can get a better feel for your monthly average as the seasons change.

Related: How to Budget With an Irregular Income

3 ) Observe your current spending

After you have determined your average monthly income, compare it to your average spending.

Have you been spending more than you are taking in? Or have you been spending less than you have been earning?

If you have been spending more than your monthly income, you are living outside of your means and you will need to make some adjustments to your spending. If you have been spending less than your income could you be saving even more by cutting back?

Also, look closely at what you have been spending your money on. Does it align with your core values? If you value time with your family, your health, as well as your church, is that where you are allocating your money? Or is it going towards other things?

Furthermore, do you see areas within your different categories in which you are spending more than you probably should? For myself, when I first started tracking my money, I realized I was spending hundreds of dollars a month on coffee and eating out for lunch. It was excessive and once I saw what I was doing I was able to cut back.

This step is especially important if you are trying to build a value-based budget, which is simply a budget that helps you focus on the things that matter most to you!

4 ) Adjust your spending

Now that you have made your observations it is time to adjust your spending and actually create your budget.

This is where you will want to start:

- Eliminate where your spending doesn’t align with your values

- Cut back on excessive spending areas

- Be realistic with how much you spend

Start to create budgets for each line item and make sure to stay realistic with your expectations. Make sure to create a line item for everything that you purchase. Either plan to put it within a certain category or make a budget for that thing specifically.

Here are 7 things you could possibly stop paying for in order to increase your savings and 25 simple ways to save money starting today! Also, check out easy switches that will save you money and the planet.

5 ) Set goals

Hopefully, after adjusting and/or eliminating your spending you have money left over. It may be a good idea to decide exactly what you will do with that money so you are not tempted to spend it.

Here are some ideas for some goals you can set for that money you have leftover.

Financial Goal Examples:

- Build an emergency fund

- Put it in an investment account

- Save up to buy something (Buy a house, education, etc)

- Pay off your debt like student loans or car payments

More On Goal Setting:

How To Set Yourself Up For Success

Your Biggest Goal Setting Mistake

How to Recognize Bad Goals

5 Biblical Tips to Help You Achieve Your Goals

The Key To Accomplishing Your Goals

Let Your Budget Be Fluid

In the first few months after creating your budget give yourself some grace. You may not get it perfect the first time around. You may find certain areas where you don’t spend as much as you thought and you may also find areas where you just can’t stay under your budgeted amount.

One of the most difficult line items for my husband and me to nail down was our grocery budget. We thought we could easily cut back on how much we were spending on groceries, but month after month we ended up overspending.

Eventually, we came to the understanding that we just needed to raise our budget for groceries and that felt like a budget failure. But after raising it just a bit we were able to stay within that limit and still save money.

Remember that your budget will not stay the same over the years, and maybe even over several months. Things change, different life events happen, someone may gain or lose a job, or maybe you have a child or adopt a puppy!

Spend Time Reevaluating Your Budget

One of the most beneficial things that we started doing with our budget was to check it monthly. Before we started doing this, we were overspending a lot and just not finding a lot of value from having a budget. But that was because we weren’t continuously coming back to it.

Set a calendar reminder to revisit your budget so you can make sure you are staying on track with your spending. Especially if you are using an automatic budgeting tool. If you overspent in one area you can make adjustments for the next month.

Budget Resources

Check out our Super Simple Budget Spreadsheets with a training video to show you how to set them up properly.

Are you looking for ways to increase your monthly income? Check out some of these side hustles:

Avail Car Sharing

Field Agent App

Cash Back Apps

Starting a Blog

Flip Used Items

Ready to transform your financial journey through faith-based guidance? Book an empowering call with Katie Jones, a Certified Christian Financial Counselor, today and pave the way for abundance and blessings in your life!

Find Out If Faith-Based Money Coaching is Right For You

You May Also Like

Can We Pursue Both Faith and Financial Independence?

10 Things to Stop Paying For So You Can Save More Money

How To Save Money To Buy Your First House

4 Ways to Discern How God Wants You to Spend Your Money

Good share…The Topic of our lesson (Budgeting) started the previous Sunday going into this

coming sunday in the men ministry at our church.

I’m so glad your church is teaching about how to budget! It was never something I was taught in church, yet the Bible has so much to say about money management.

Good share..

Creating a budget makes your life more easy. This helps you track your expenses and savings in daily record. Also some tips like setting and observing your current savings helps. Thanks for this post.

Thanks for sharing these easy 5 steps to follow for creating a budget. This would help me further in making good financial habits.