Are You Falling For These 3 Budgeting Myths

Let’s face it, there is a ton of advice out there on how to handle our finances, how to budget, and what we should be doing with our money. A lot of what people believe about money are complete myths, in fact, there are a lot of budgeting misconceptions. So how do we determine what to believe and not to believe?

Don’t worry, in this article, we will look at 3 budgeting myths that you should be careful not to fall for. If you can overcome these things, you are sure to set yourself up for financial success in the near future.

Budgeting Myth 1

“I have enough money to cover my expenses, therefore I don’t need a budget“

This first budgeting myth is ultimately saying that “budgeting is for broke people.” While budgeting can be crucial when you have a low income, budgeting can really be the difference between you achieving or not achieving your financial goals when you have “enough” money.

Let me ask you this question, what are your future plans?

Do you want to buy a bigger house?

Send your kids off to college debt-free?

Pay off all of your debt?

Be able to retire?

Maybe you would feel more secure with an emergency fund?

Do you have other big plans for your future?

Good! It is fantastic to plan these things out. Now let me ask you a second question…

How far along are you toward that goal of yours?

If you don’t have an answer, in dollars, for that question, that’s because you don’t have a budget.

By not having a budget, you are not in control of your financial future! Budgeting allows you to gain back control and ultimately guide your money on the path toward financial freedom.

If you don’t take control your money now, your money will ultimately control you as your income grows.

Have you heard of lifestyle creep?

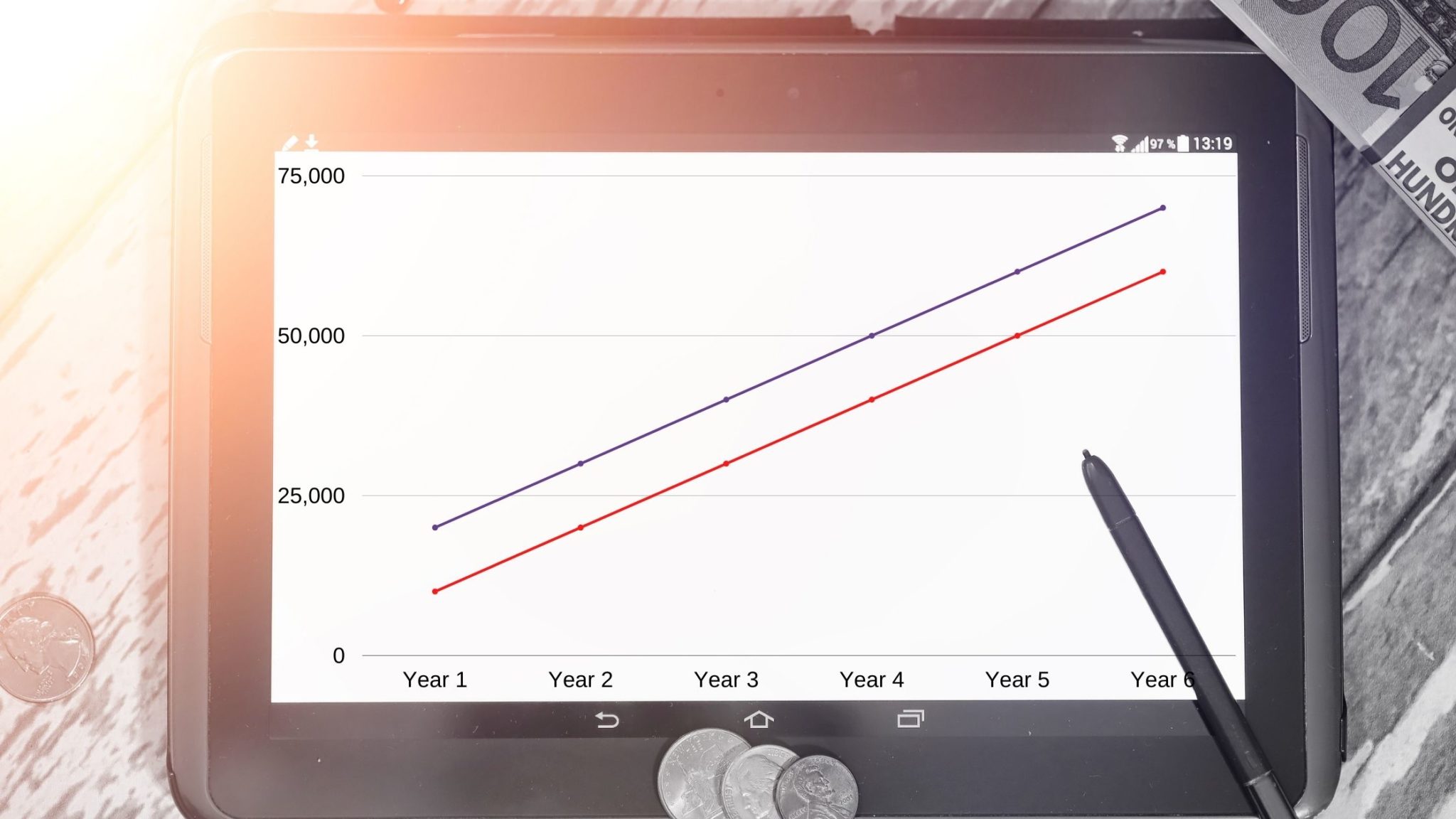

Lifestyle creep is when your spending increases as your income increases (see image to the right). It is something that we as humans, and especially as Americans, do without noticing. We get a raise or a bonus and want to go buy something newer, nicer, or bigger. And poof, there goes our extra $1,000 a year.

It’s easy to do when you don’t have a budget telling you where to spend your money.

Jesus also tells us how important it is to budget in Luke 14:28. He says, “Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost to see if you have enough money to complete it?”

Replace “build a tower” with your own goals and you will see that Jesus found it important to first evaluate before you jump in.

Related: 8 Bible Verses About Budgeting

Budgeting Myth 2

“Tithing doesn’t matter until I make more money“

This myth is practically saying the opposite as budgeting myth 1, that budgeting isn’t important until you have money.

However, it is important to take charge of even the very little that we have so we can make it do more than we ever thought possible! That way you don’t acquire any bad money habits that will just follow you throughout life.

This myth is challenging because I know that it can be very difficult for people to “give away” money when they might be struggling with their finances. But God challenges to give even when we feel like we cannot.

We see Jesus’ pleasure in the widow who gave everything she had in Mark 12:41-44. She handed over her very last two coins because she trusted that God would still provide for her.

If we plan out our incomes to the very last cent, we will be able to still give even when money is tight, and by prioritizing our giving, we are honoring God with our money.

Tithing Example

I will share a quick story of when I left a high paying job for one that paid about half of what I was previously making. Not only that, but my expenses went up because I had a company car at the time. I had to go buy a car as well as start paying for gas, insurance, and maintenance.

But even though I lost a lot of income, my husband and I got really serious about budgeting so that we could still be able to give exactly what we were already giving. This meant that the percentage of our income that we were donating increased!

This might seem unbelievable at first. But we realized that we had a lot of unnecessary spending that didn’t really align with any of our core values, and didn’t bring us a ton of joy in the long run.

Jesus also tells us to manage the little that we have now in order to prepare for having more in the future. If we don’t handle our finances well when we have very little of it, those habits will continue to transfer over when we have more money in the future. So many people have stories like this where they have applied their faith into their finances.

If you are faithful in little things, you will be faithful in large ones. But if you are dishonest in little things, you won’t be honest with greater responsibilities. (Luke 16:10)

Not only is it a sign of faith when we tithe, but Jesus practically tells us that tithing is the KEY to financial freedom! It’s true!

Budgeting Myth 3

“I can always start saving/investing/budgeting/paying off debt later“

You may be thinking, I want to spend all my money now so I can be happy in this moment! That sounds great! But why do you need to spend money now in order to be happy?

One of the main reasons I hear people not wanting to start a budget or put money away in savings is that they think budgeting is challenging or that it will restrict them from having fun right now.

There are a lot of simple ways to save money today that won’t be very restricting to your current lifestyle, but if you are serious about achieving your own goals you have to ask yourself what you are willing to give up in order to achieve them? What are you willing to stop paying for in order to achieve your financial goals.

Budgeting can be as restricting as you make it. When you decide to create a budget you have to ask yourself, why am I starting this budget? What is it that I want to be able to do with my money and what are my future goals? These are the first questions you should be asking yourself with any financial journey.

And by answering that question it leads you to another one –

What am I willing to give up in order to reach that goal?

How serious am I about achieving my goals?

So yes, if you get serious about pursuing your goals, you may end up eliminating things like fancy coffee drinks or a gym membership you rarely use anyway.

But no one should ever tell you you HAVE to give those things up. I’m not even here to tell you that you must give up everything you love in order to save money. I’m simply here to ask you the question, what are you WILLING to give up in order to run after your dreams?

But on the flip side, budgeting can also be extremely freeing!

You may be surprised to find out how simple it is to cut back your expenses once you start tracking your money in the first place. And by cutting back in just a few areas, you free up your money to do more of what you love!

I’ll share another story, a few years ago I used to spend $400-500 on coffee and eating out for lunch. I had NO IDEA that I was spending so much on these things before until I started tracking my money.

Once I realized how much I was spending, I knew that I could easily stop spending that money. I decided to make coffee at home, and pack a lunch for work. It was a no brainer! And then I had $500 to do other things with!

Budgeting allows us to gain control over our money. Once we become aware of how it is in control of us, all we need to do is take the next step and create a budget that allows us to spend on the things that matter most to us!

Ask yourself if you are falling for any of these budgeting myths or any others?

What To Do If You Fall For These Budgeting Myths

The best time to get serious about your financial future was yesterday.

The 2nd best time is today!

Don’t let your past mistakes define your future!!

Falling for these budgeting myths can be detrimental to achieving your goals.

It is crucial that you take charge of your finances today! Set up a budget in 5 easy steps. Overcome the challenges of budgeting and really begin to imagine how your life can change if you make these changes today!

You May Also Like

4 Things I Did to Pay Off My Student Loans Early

Habits I Picked Up While Pursuing Financial Independence

What Does the Bible Say About Debt?

Can We Pursue Both Faith and Financial Independence?